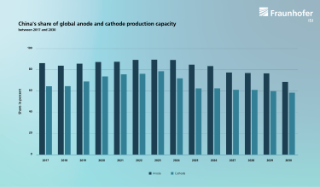

Fraunhofer ISI has been active in the field of battery technologies for over ten years. The technological focus of our battery activities is on lithium-ion batteries. However, also alternative battery chemistries and systems that could reach market maturity in the next few years are continuously monitored and analysed.

Fraunhofer ISI's research questions in the field of batteries range from the evaluation of research and development of new battery technologies in the laboratory to suitable funding strategies, technology commercialisation, industrial production, usage phase and finally end-of-life treatment.