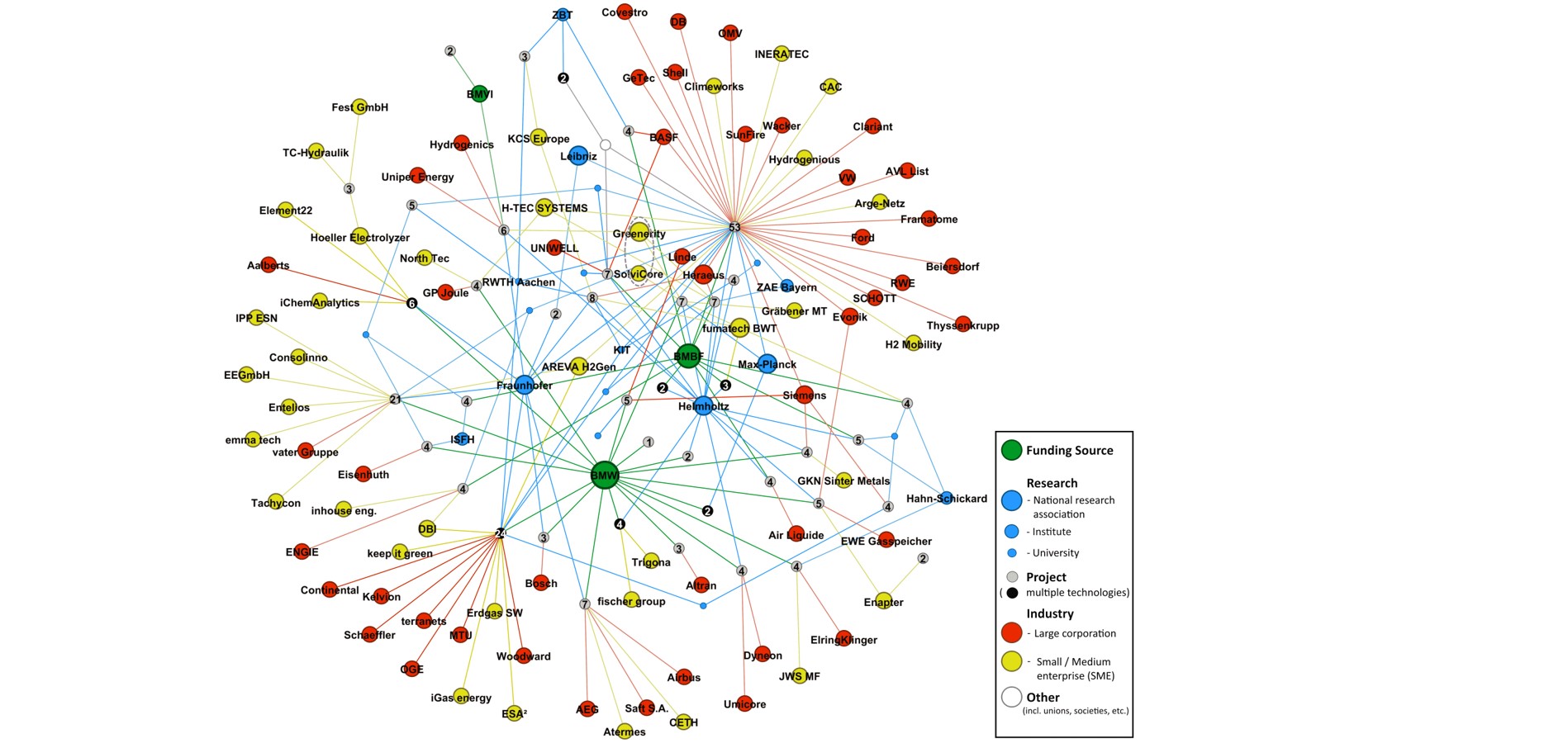

Figure 2 visualizes refined and complemented data associated with 40 collaborative research projects identified via EnArgus searches for membrane-based electrolysis technologies.

For easier interpretation, we introduced a colour-code to distinguish various types of actors:

- funding sources (in green)

- large industrial entities (red)

- small and medium-sized enterprises (SMEs; yellow)

- R&D: research and development actors (universities, institutes and national research associations; blue)

- other (networks, associations, etc.; white)

- Publicly-funded projects (grey; or, when encompassing multiple technologies, black; i.e. for alkaline and HTSO)

In particular, the network graph visualizes actor relations (edges) with publicly funded projects (f), which are displayed with a number representing the degree of that node (total number of direct connections). Thus, it expresses the number of full members (recipients of funding) in each project consortium. Note that any actor of the “R&D” or “other” categories with a degree below two (i.e. only one project participation) were omitted from the visualization in Figure 2.

In our representation, node size scales by its degree to emphasize the relevance of actors active in multiple projects. In contrast, other factors (the amount of funding received) are not stressed in our visualizations. We also substantially simplified the representation of R&D actors. To be precise, small blue dots represent universities and similar educational institution. Large blue dots group research institutes according to their national research association membership. Mid-sized blue dots mark independent institutes. All three categories appear in standard sizes (not scaled to their project participation degree).

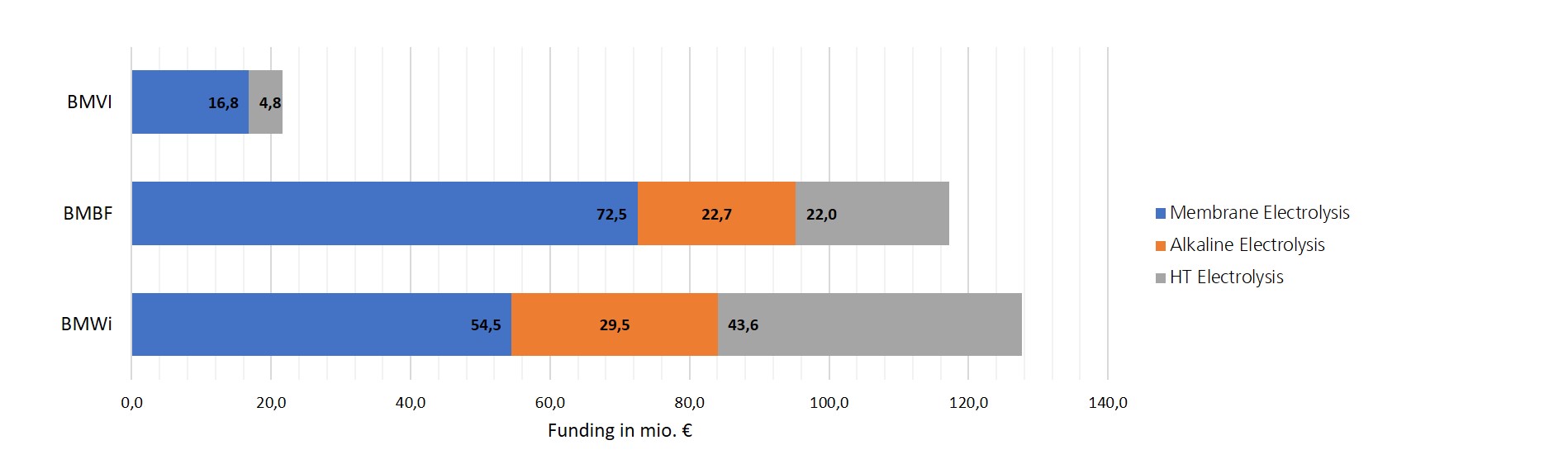

In the field of electrolysis, three federal ministries act as most relevant funding sources:

- The Federal Ministry for Economic Affairs and Climate Action (BMWi)

- The Federal Ministry of Education and Research (BMBF)

- The Federal Ministry of Transport and Digital Infrastructure (BMVI).

Clearly, BMWi is the most frequent funding source for projects related to membrane-based electrolysis techniques in Germany. BMBF funded a smaller number of projects in this field, but inclines to larger ones, as evidenced by the size of some consortia displayed in Figure 2. Among these, the P2X project stands out with 53 members in their consortium.

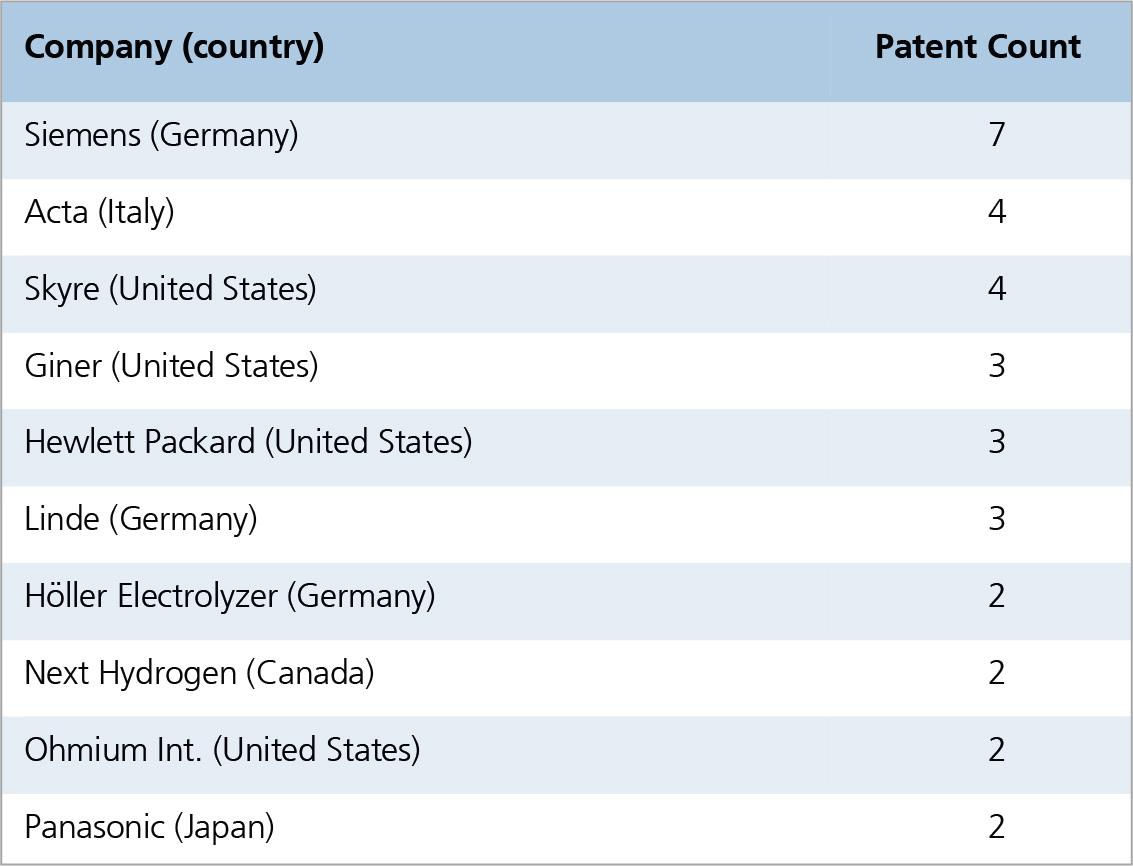

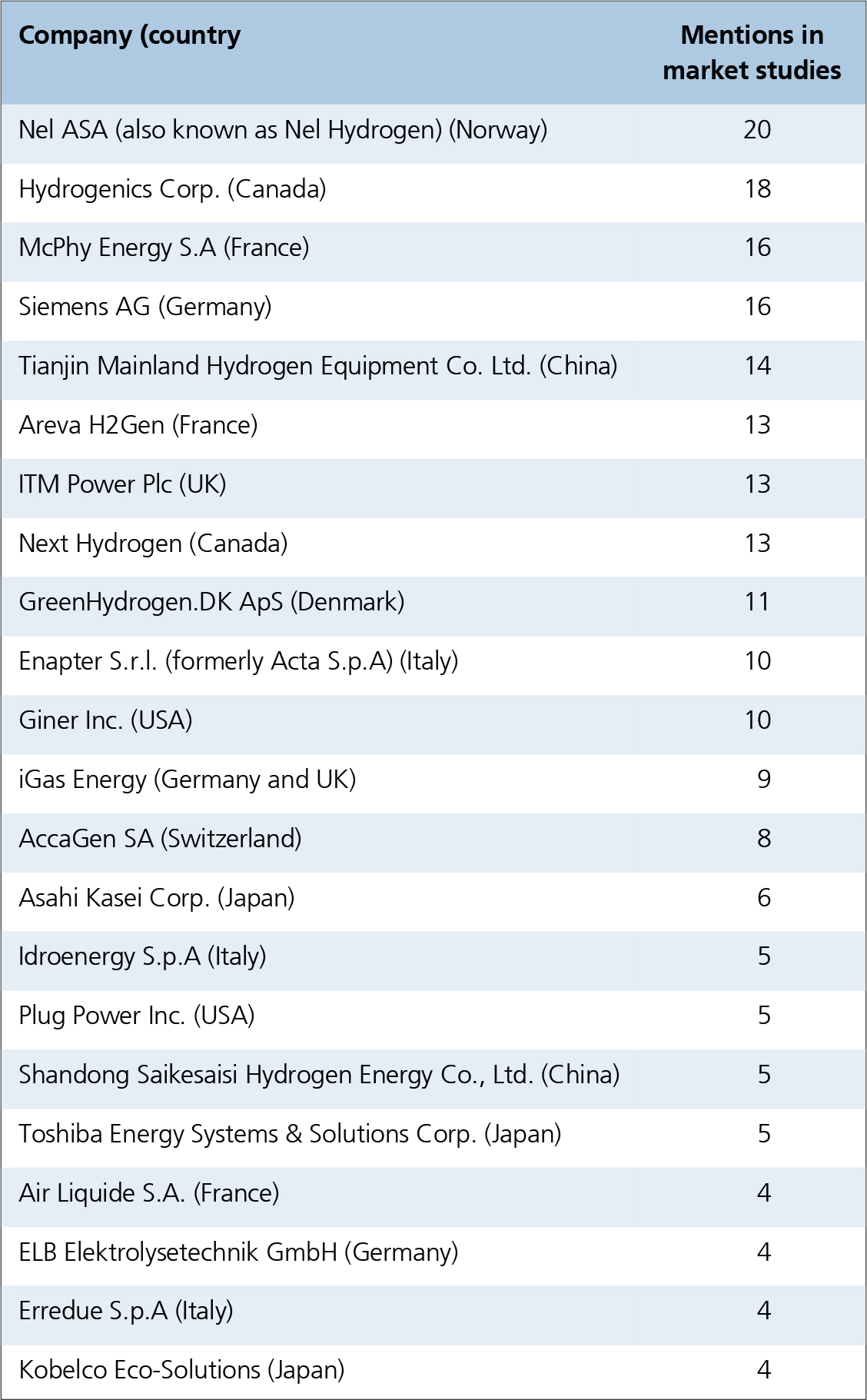

In general, the visualization of our network analyses highlights industrial actors. Among projects focussing membrane-based electrolysis, we recognize the companies Fumatech BWT, Heraeus, Siemens, Greenerity, H-TEC SYSTEMS, and AREVA H2GEN as frequent beneficiaries. The SME Fumatech BWT specializes in membrane manufacture and plant technology[1]. Heraeus is a multinational technology group centered on supply of key materials for various sectors[2]. Siemens self-brands as a “technology” company with a plethora of divisions worldwide (Energy being among those)[3]. The SME H-TEC Systems focuses on PEM electrolysers and stacks[4]. Finally, AREVA H2Gen (now named Elogen) specialises in PEM electrolysis, too[5].

Note that name changes occur rather frequently, in particular among industrial actors, often driven by mergers and acquisition. For instance, SolviCore was founded as a joint venture of Solvay and Umicore in 2006. It was renamed Greenerity in 2015 when acquired by Toray[6]. We generally represent entities by their affiliation utilized in the project context.

However, in case transactions known to us lead to simultaneous representation of essentially the same entity in the visualization of a research network, we grouped and marked those (by dashed encirclement). Note that our knowledge of these changes remains coincidental (and bases on complementary research). Hence, other instances (currently unknown to us) may lack representation in our graphs.

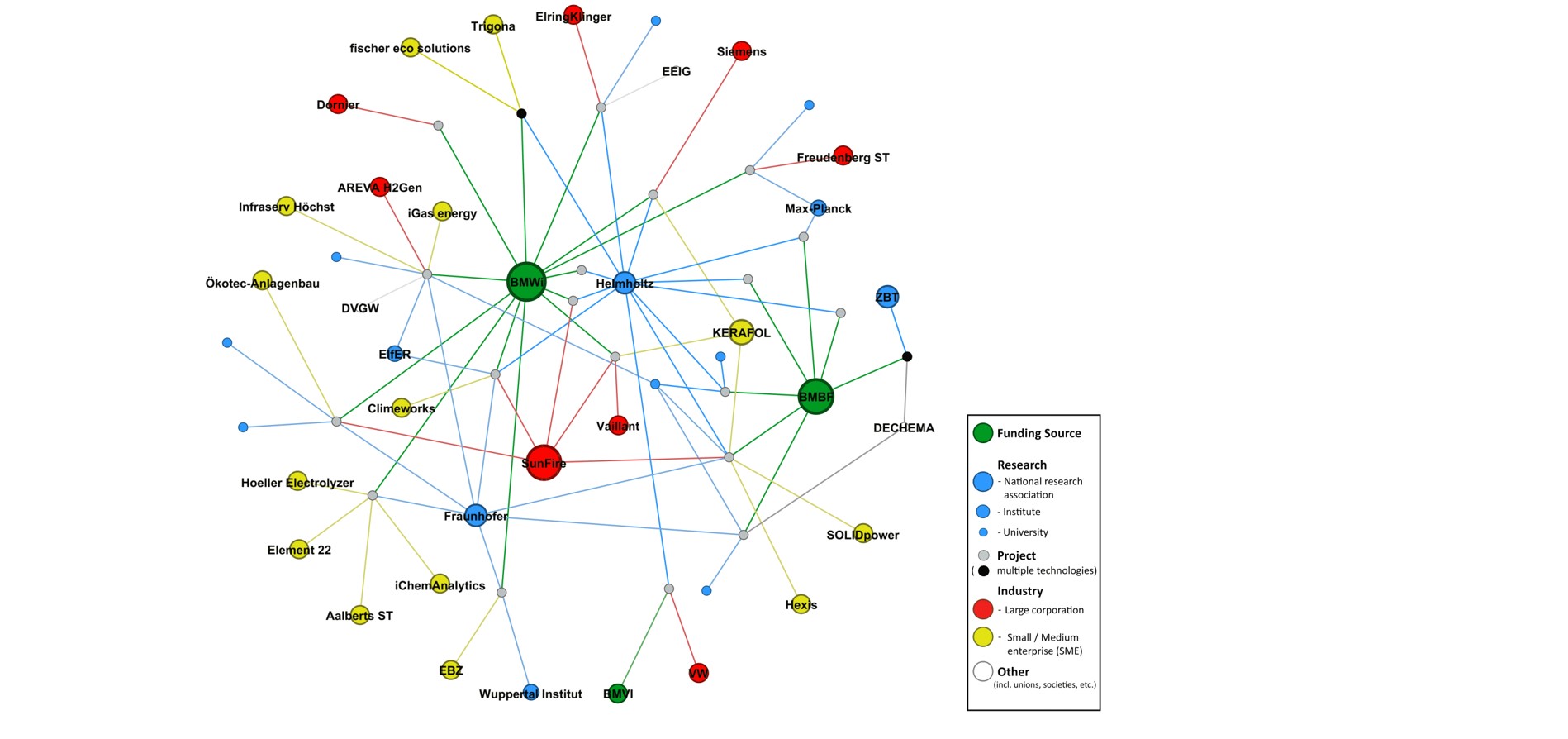

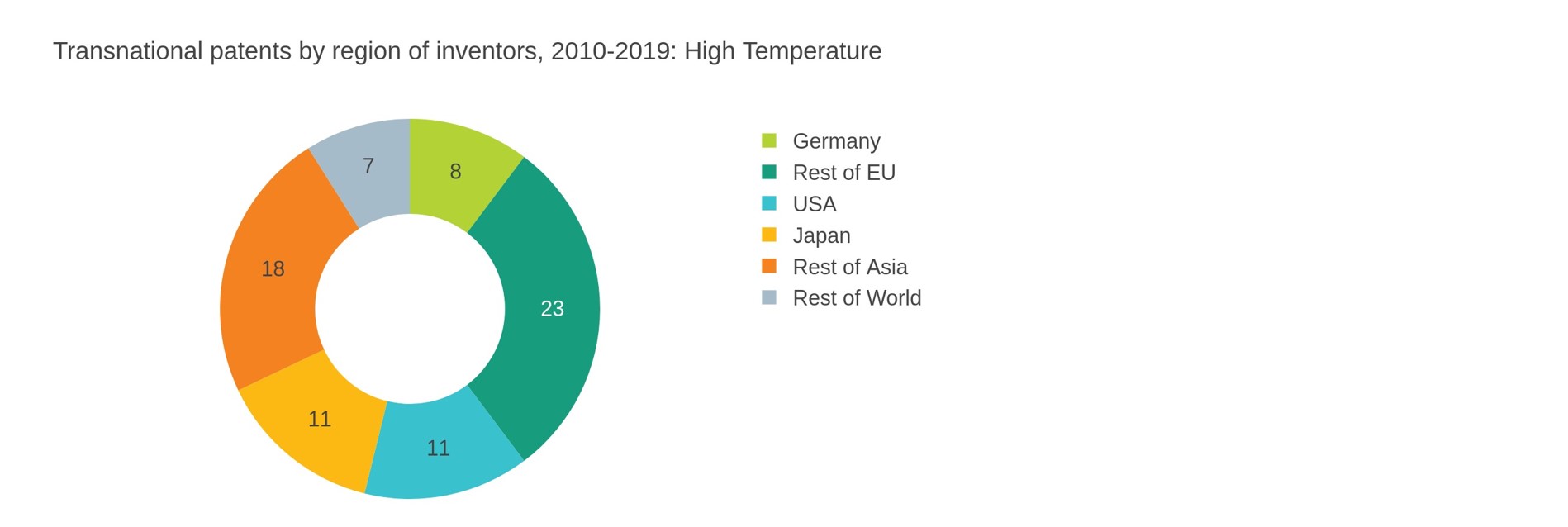

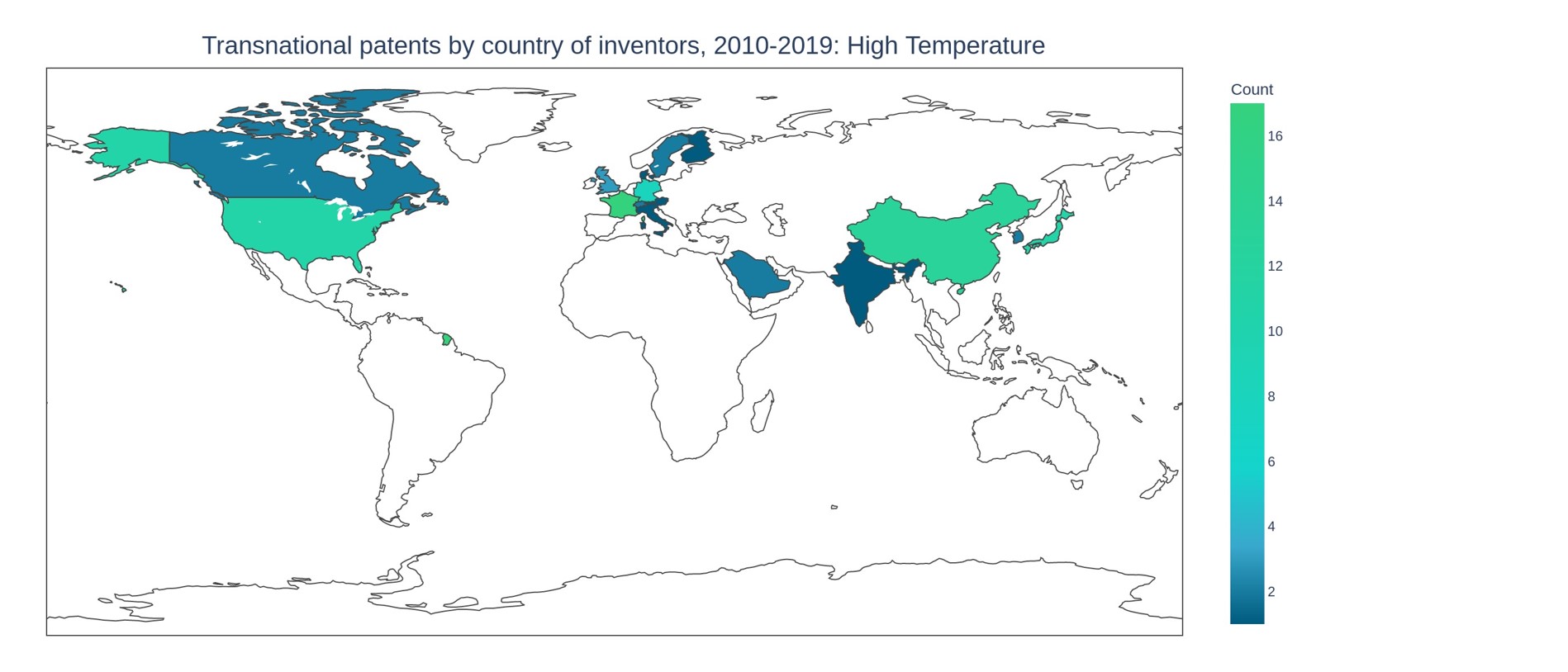

High-Temperature Electrolysis Technologies