Battery cell production in Europe: In which countries will European manufacturers dominate – and where do international companies want to gain a foothold?

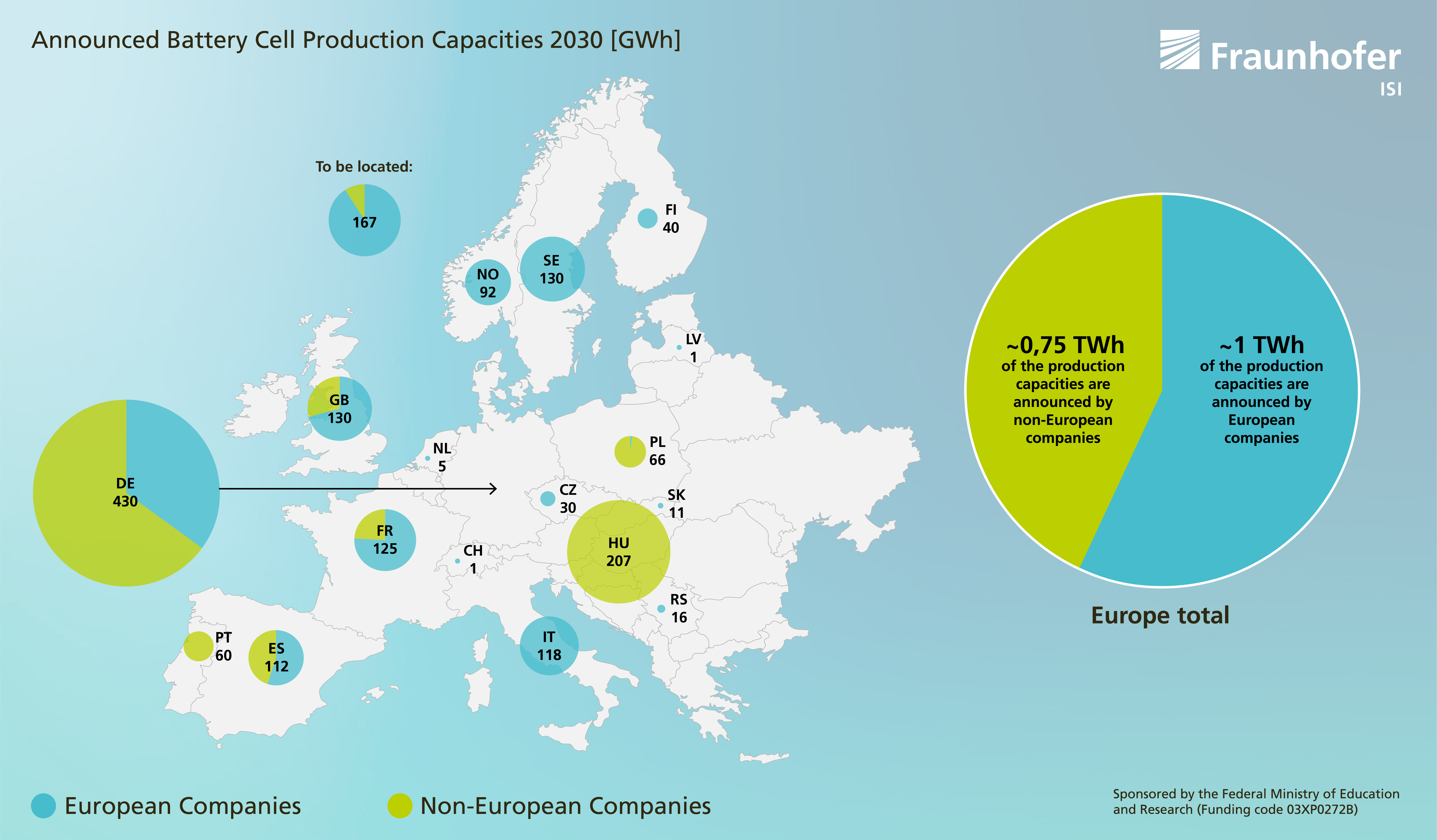

In recent years, a large number of battery cell factories have been announced in Europe and the momentum is still not slowing down. Just recently, new plans by two Chinese cell manufacturers (CALB in Portugal and CATL in Hungary) have increased the total maximum cell production capacity announced in Europe - i.e. the total capacity of battery cells that would be produced if all the announced factories were built on the announced schedule and operated at maximum capacity - to up to 1.7 TWh by 2030.

CATL had already previously announced a so-called Gigafactory in Germany. CALB is now becoming active in Europe for the first time. So two new large cell factories are being built by Chinese companies in Europe - a trend that fits in with recent reporting on Chinese activities in Germany and Europe, such as in the port of Hamburg?

Most announcements in Europe come from European manufacturers

Viewed across Europe, these figures are put into perspective: European cell manufacturers have announced up to 1 TWh of cell production capacity in Europe this decade. The remaining 43 percent of the announced maximum production capacities come primarily from Asian cell manufacturers - apart from China, mainly from Korean companies.

There are only five European countries, including Germany, where the majority of announced production capacity is not from European companies. While this makes Germany the country with the most announced production capacity from non-European companies (279 GWh), it also remains the country with the largest announced production capacity from European companies (151 GWh).

In addition to Germany, Sweden (with the extensive announcements of Northvolt) and Italy (ACC, FAAM and Italvolt) each have over 100 GWh announced by European companies. Non-European cell manufacturers can be found besides Germany mainly in Hungary - with announcements of the Chinese companies CATL and EVE, as well as already existing cell productions of the Koreans Samsung SDI and SK On.

Non-Europeans dominate in the short and medium term

These are the announcements until 2030. At least in the medium term, however, the non-European cell manufacturers will still dominate the local cell production. Only after 2025 will the European cell manufacturers catch up with the non-European manufacturers.

Whether and how these announcements will ultimately be translated into reality depends, of course, on many factors - will there be delays or will some projects fail completely? The fact that Asian companies can build large factories in a short time has already been demonstrated on many occasions - CALB in China, for example, is said to have recently built a 50 GWh factory in just over a year. Many Asian companies are already established cell manufacturers, so their plans could be given a higher probability of realization than those of European start-ups, especially when it comes to quickly ramping up production.

For example, the British start-up Britishvolt ran into extensive financing difficulties, so that their expansion plans may be questioned. However, the Chinese players also have to adapt to the European framework conditions, which does not rule out delays in the development of production capacities. The Chinese manufacturer Farasis Energy found out that plans can also fail completely when the city of Bitterfeld-Wolfen (Saxony-Anhalt) canceled the construction of a factory, at least for the time being.

These possible developments underline the importance of observing the build-up of production capacities that is now taking place. For achieving an economic sovereignty in the battery value chain, a successful implementation of the European plans is certainly desirable. In this way, existing market structures can be broken open to give the opportunity for establishing upstream value creation such as component and material production or machine and plant construction in the large emerging battery industry in Europe.

The data used in this article comes from the BEMA2020 research project, which is funded by the German Federal Ministry of Education and Research (grant number 03XP0272B).

![BMBF_CMYK_Gef_M [Konvertiert]](/en/blog/themen/batterie-update/batterie-zell-fertigung-europa-hersteller-europaeisch-international-kapazitaeten-2030/jcr:content/fixedContent/pressArticleParsys/textwithasset_208279/imageComponent/image.img.jpg/1669109419622/BMBF-gefoerdert-2017-en.jpg)