Hydrogen: Which import strategy for Germany?

A meta-study conducted by Fraunhofer ISI as part of the HyPat project has evaluated existing studies of the generation, production, and trade of hydrogen. The findings were compiled in a position paper and used to derive recommendations for action that clearly differentiate between importing pure hydrogen and importing hydrogen derivatives.

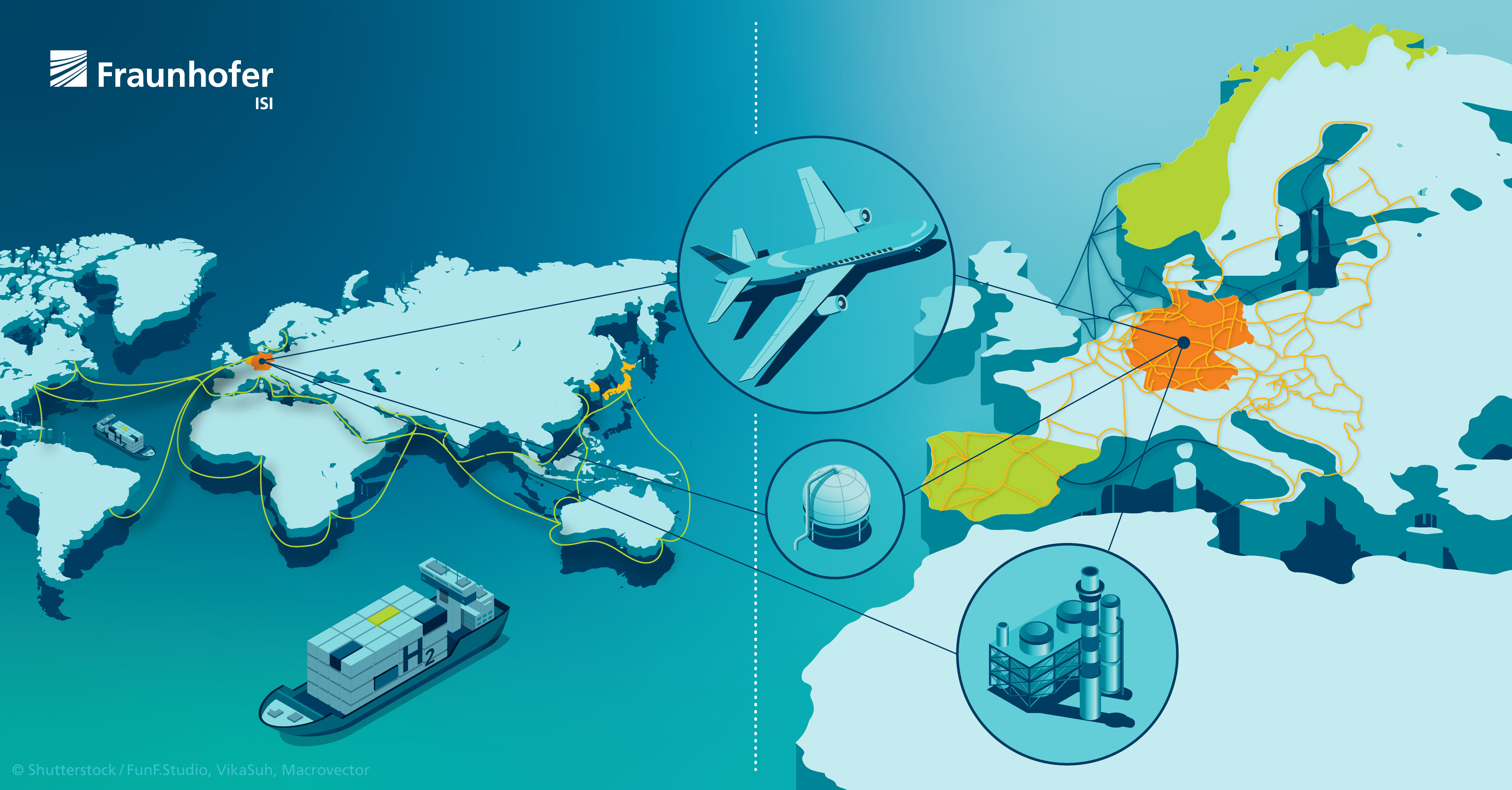

In its revised hydrogen strategy, the German government estimates that around 50 % to 70 % of the forecast demand for hydrogen in 2030 will have be covered by imports from abroad.

Against this background, a team of researchers from Fraunhofer ISI analyzed numerous studies of the costs for generating, producing and transporting green hydrogen and hydrogen derivatives in the HyPat research project, which is funded by the German Federal Ministry of Education and Research. The findings were used to derive recommendations for Germany’s import strategy.

Global hydrogen demand can be met using green hydrogen

The studies assume a global demand for hydrogen of 4 % to 11 % of final energy demand by 2050. When related to the global supply, this demand can still be met by green hydrogen even under highly restrictive assumptions such as excluding regions with water stress or geopolitical instabilities. At present, however, there are a number of obstacles to the market ramp-up, so that this is currently only progressing very slowly.

According to the study, locations with good photovoltaic conditions ideally combined with good wind conditions are the most favorable to generate the electricity needed to produce hydrogen, as they have the lowest production costs. Future hydrogen-exporting countries should have access to low-cost financing and national funds to keep capital costs low as these have a strong influence on the overall costs. Aspects such as water availability, political stability, technology expertise and transport distances also play a key role.

From a global perspective, international hydrogen trade will be limited

Global trade between 2030 and 2050 will only make up one-third of total demand, because the demand for hydrogen imports is rather low and many countries such as the USA or China, for example, can meet most of their own demand themselves. However, this is not the case for Germany. Since green hydrogen and hydrogen derivatives will remain in relatively short supply and be rather expensive in the short and medium term, an import strategy should focus on areas in which hydrogen is essential to achieve the climate targets: For example, in the steel and basic chemical sectors, international aviation and shipping or refineries.

Some of the countries that could potentially export hydrogen and its derivatives are pursuing strategies to retain higher shares of value-added chain at home and to export sponge iron for steel production or chemical products such as ammonia instead of hydrogen, which poses a challenge to German industries. Countries such as the United States or Canada that have large and low-cost resources to produce green hydrogen and already hold substantial market shares in industrial applications for which hydrogen could play a major role in the future, could become market leaders by integrating segments of the value chain for green hydrogen into production and industrial applications.

The trade with pure hydrogen will mainly be organized on large-scale, regional markets with a radius of 2,000 to 3,000 km, for which pipeline transport will be the predominant option because of its cost advantages, and ship imports will tend to have a more risk hedging function. In contrast, an international market similar to today’s oil markets is likely to emerge for hydrogen derivatives, for which ship transport will play a vital role.

With regard to the recommendations for action, according to the meta-study, Germany’s import strategy should make a clear distinction between hydrogen and hydrogen derivatives.

When importing pure hydrogen, the following aspects should be taken into consideration:

- Infrastructure: Constructing a pipeline network takes time and is capital-intensive, but can be achieved due to the slow take-off of the market.

- Learn from past experience: Avoid repeating the mistakes made during the construction and expansion of the natural gas network such as relying on only a few suppliers like Russia. This means not automatically choosing the import pathway with the lowest costs.

- Demand reduction: Demand will be limited from the outset by improving efficiency and focusing on the really essential hydrogen applications.

- Diversification: Dependencies will be reduced by having different suppliers, routes and modes of transport as well as producing certain quantities domestically.

- Greater resilience: Resilience can be increased by storing hydrogen domestically, and preparing for supply bottlenecks should be expanded.

- Market differentiation: Different requirements for hydrogen production, regarding environmental standards for instance, favor the emergence of small markets and higher prices, and this should be avoided from the viewpoint of economic efficiency as well as investment and supply security.

- Give preference to imports from the EU and its neighboring countries: From an economic perspective, Germany should concentrate on EU countries with good renewable potential like Spain and countries bordering the EU like Norway. These are reliable partners and this would make the EU stronger overall.

The import strategy for hydrogen derivatives should take the following into account:

- Competition and cooperation: Germany should consider the other two countries with a high need for imports, Japan and South Korea, as competitors, but also as potential cooperation partners.

- Hydrogen Alliance: Germany should try to find common ground with other importing countries in the EU such as the Netherlands and Belgium and with the EU as a whole for market power reasons, for instance in a European Hydrogen Alliance.

- Differentiation by derivative: An import strategy should consider the specific characteristics of hydrogen derivatives such as e-kerosene, ammonia or methanol.

- e-kerosene will be needed to achieve the climate targets in aviation; there are hardly any alternatives here. Existing import infrastructure can continue to be used.

- Methanol can be used as a fuel and as a raw material in the chemical industry. So far, however, there is only limited infrastructure and ships to transport it.

- Ammonia could be used as a carrier for hydrogen, but this is accompanied by high conversion losses and is therefore expensive. Ammonia could be used directly for shipping and possibly electricity generation in the future, although the latter is at a very early stage of development.

Germany should already be approaching potential export countries

Prof. Martin Wietschel, Head of the Competence Center Energy Technology and Energy Systems at Fraunhofer ISI and a co-author of the HyPat position paper, summarizes the meta-study: “The German government will present its import strategy for hydrogen in the spring. This must consider a number of aspects, above all to treat hydrogen and hydrogen derivatives separately. Precisely because the demand for imports will be limited internationally, Germany, in coordination with the EU, has to approach potential hydrogen-exporting countries now, which will exert significant market power in the medium term. Negotiations should not be drawn out unnecessarily to avoid first movers considering other hydrogen-importing countries. Therefore, the aim should be to jointly develop technologies and business models together with the exporting countries, treating them as equals and spreading the associated risks fairly. This not only creates local value added but also drives local energy transitions and, ultimately, will also help Germany to achieve its own climate targets”.

Always up-to-date

The Fraunhofer Institute for Systems and Innovation Research ISI analyzes the origins and impacts of innovations. We research the short- and long-term developments of innovation processes and the impacts of new technologies and services on society. On this basis, we are able to provide our clients from industry, politics and science with recommendations for action and perspectives for key decisions. Our expertise is founded on our scientific competence as well as an interdisciplinary and systemic research approach.

Last modified: