Battery starting materials - the Asian dominance in battery components

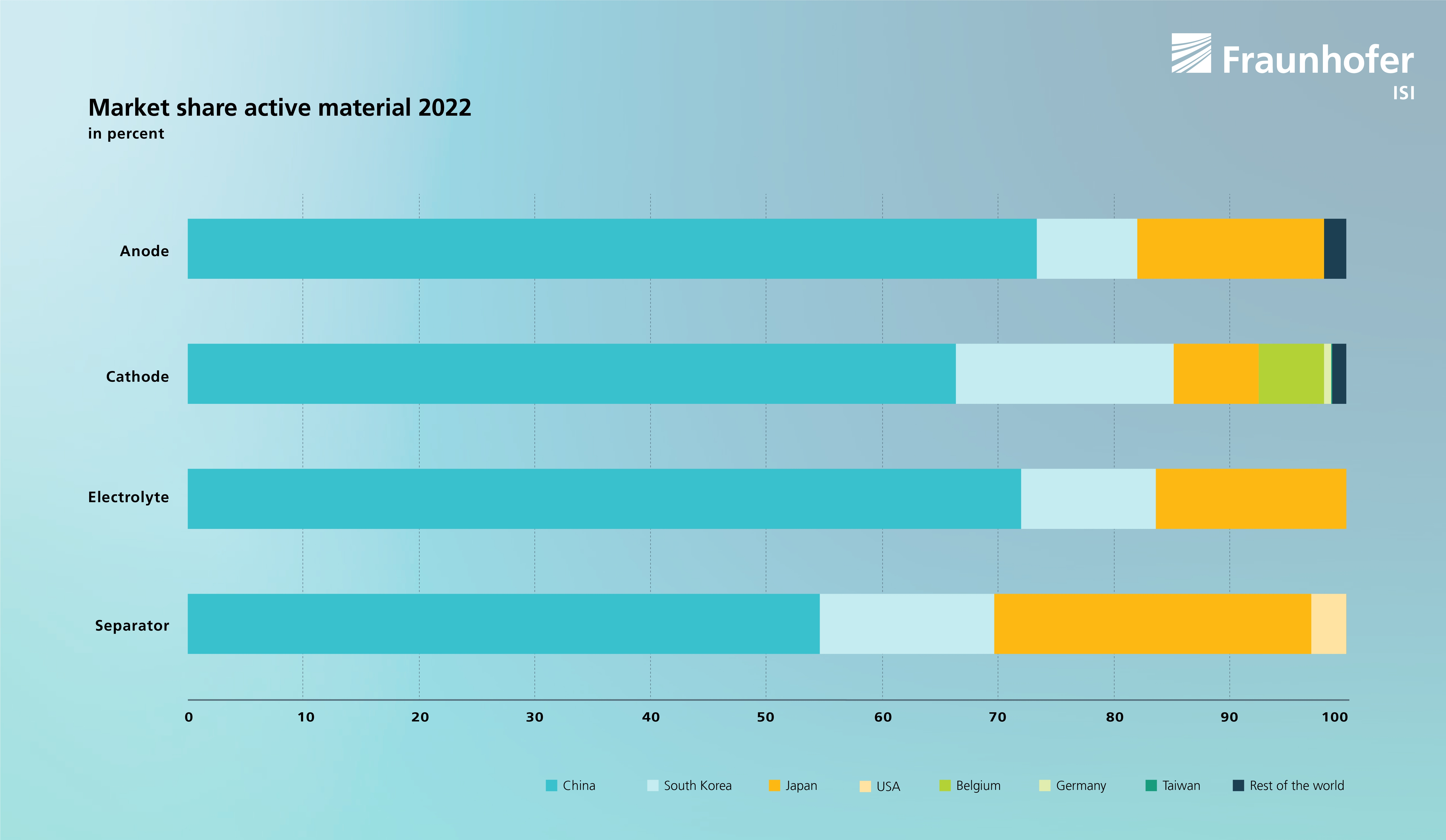

It is well known that a large part of battery cell production takes place in Asia, more precisely in China, Korea and Japan. However, it is often overlooked that this market dominance is even more pronounced in the prefabricated production steps of battery manufacturing. More than 90 percent of the main starting materials of a battery cell (i.e. anode, cathode, separator and electrolyte) come from these three countries.

In recent years, the battery industry has established itself mainly in Asia, so that the material manufacturers there have entered the supplier market. With the growing demand for battery cells (partly also due to the availability of raw materials there), they scaled their production volumes.

Thus, by 2022, 98 percent of anode and separator production was in the hands of Chinese, Japanese and Korean companies, as well as 92 percent of cathode production and as much as 100 percent of electrolyte production. Figure 1 shows that the Chinese share is particularly dominant. For example, China has a market share of more than 70 percent in anode material production.1

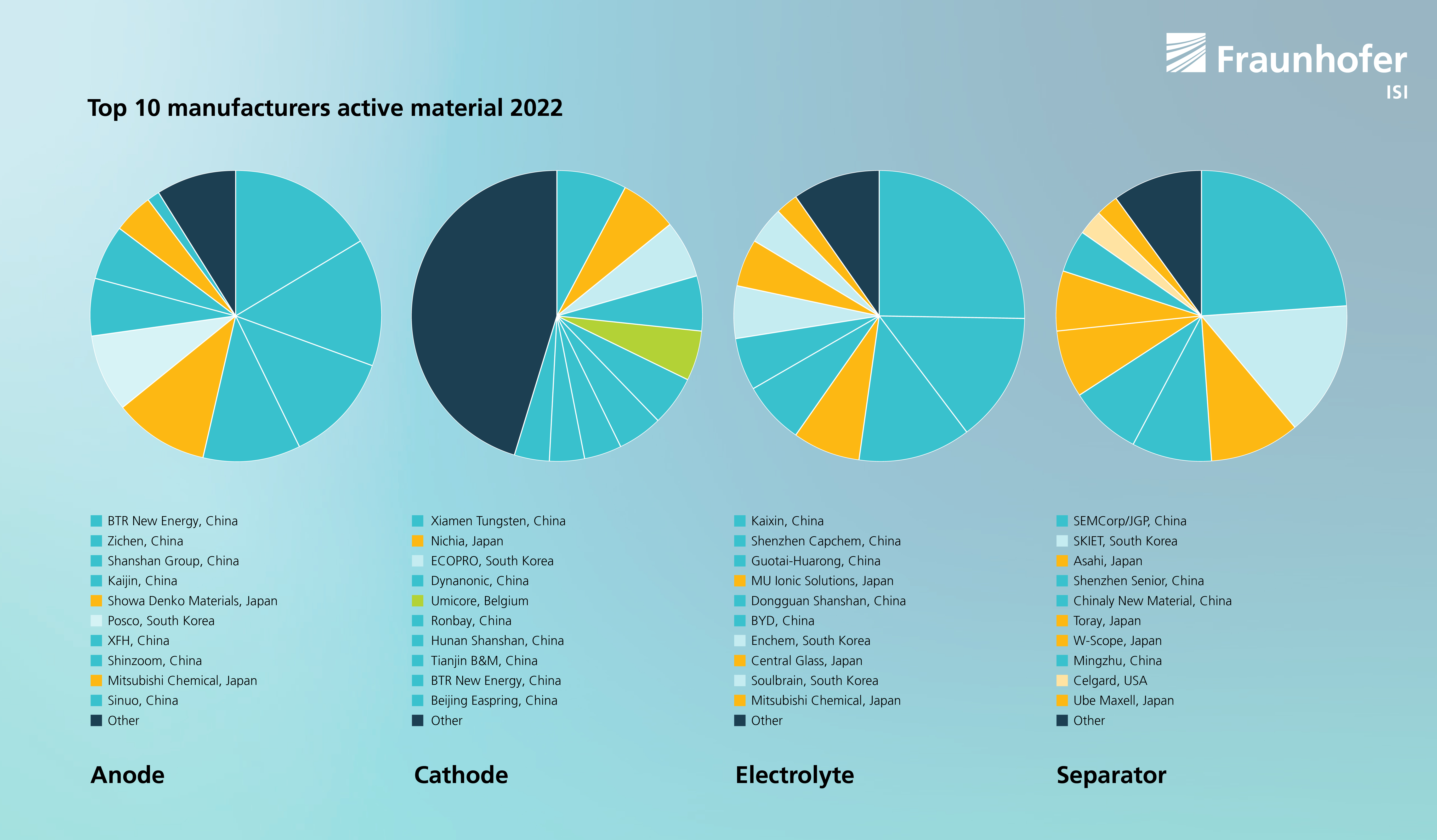

The market shares of individual companies are distributed differently for the four active materials. The clear market dominance of a few companies is striking. While the three largest players have a market share of around 50 percent for electrolyte and separator materials, the market share of anode manufacturers is still 43 percent.

Global trends of component manufacturers

Companies producing cathode materials have smaller market shares. Here, the three largest players account for only 21 percent of the shares. The colors in Figure 2 once again show China's dominance. It can also be seen that Korean and Japanese companies are represented in the top 10 for all components. The overview also shows the largest non-Asian players in the value-adding step. The Belgian company Umicore ranks fifth among the cathode producers. In addition, the ninth largest separator manufacturer, Celgard, comes from the USA. The list is based on the location of the companies and the groups behind them.

In anode production, there are so far no European companies with globally relevant market shares, but smaller manufacturers such as SGL Carbon (Germany) or Timcal (Switzerland) are already on the market. In addition, there are further production announcements (for example Echion in Great Britain or BTR still without a defined production site).

European players in component production

For cathode materials in Europe, there is the already mentioned company Umicore (6 percent market share) as well as BASF (<1 percent market share), both already active in the market for many years. The production sites of these companies are mostly located in Asia. Umicore, however, recently established a production facility in Poland and BASF is also planning a cathode material production in Schwarzheide (Germany).

There are also other small cathode producers such as IBU-TEC (Germany) and Johnson Matthey (UK). However, the latter recently announced its withdrawal from the business. In the future, there will probably be other European production sites for cathode materials (e.g. Northvolt in Sweden or Fryer in Norway).

At present, there are no major electrolyte or separator producers in Germany or Europe. However, this was not always the case with separator production. Companies such as Freudenberg or Degussa were already developing products and some of its products were also launched on the market. However, economic factors prevented broader commercialization.

Among electrolyte manufacturers, there are companies such as E-Lyte from Germany, which are primarily active in research and development but have not yet commercialized their products on a larger scale.

It is very difficult to predict to what extent the European player landscape will evolve under the addition of the announced gigafactories. There are opportunities for entrepreneurs to serve the new demand emerging in Europe due to short transport distances and location advantages. At the same time, it is questionable to what extent new companies will be able to penetrate existing partner structures (e.g. of Asian cell manufacturers establishing themselves in Europe and their subcontractors).

New materials, for example for aqueous produced active materials, Si anodes or high voltage spinel cathode materials or new components for SSB batteries, can make the research and development taking place in Europe worthwhile and offer further opportunities for market entry.

1. Numerical values are fromTakeshita H, 2022, B3 Report 21–22: LIB Materials Market Bulletin (22Q1) (B3 Corporation)

The data used in this article comes from the BEMA2020 research project, which is funded by the German Federal Ministry of Education and Research (grant number 03XP0272B).

![BMBF_CMYK_Gef_M [Konvertiert]](/en/blog/themen/batterie-update/batterien-ausgangs-materialien-asiatsische-dominanz-bei-batteriekomponenten/jcr:content/fixedContent/pressArticleParsys/textwithasset_208279/imageComponent/image.img.jpg/1669109419622/BMBF-gefoerdert-2017-en.jpg)

Last modified: