Price fluctuations of battery raw materials: How the automotive industry reacts and their impact on cell costs

Prices for key battery raw materials have been subject to enormous fluctuations over the past two years, putting an end, at least temporarily, to the trend of falling battery cell costs. In its Battery Update, Fraunhofer ISI points out which role the design of supply contracts plays in pricing and how the changes in raw material prices affect the costs of different lithium-ion battery technologies.

Falling costs for battery cells have long been perceived as an essential condition for the widespread success of electromobility. And so more and more of the technological innovations introduced into the battery are aimed at reducing costs, even if at the same time features such as vehicle range tend to deteriorate. The largest single contributor to the cost of battery cells is the materials used in them, especially the cathode materials. In addition to lithium, the transition metals manganese, iron, cobalt and nickel are used in particular. At the beginning of the value chain is the mining of raw materials, which, depending on the deposits, is extremely concentrated (e.g. cobalt in the Democratic Republic of Congo) or distributed over different regions (e.g. lithium in South America, Australia, China and in the future also Europe). The starting materials necessary for the production of battery materials must have a high purity (battery grade), which requires various refinement steps after raw material mining, and be in the right chemical form. In battery material synthesis, the use of carbonates, hydroxides and sulphates has become established.

Spot market prices have shown a high volatility in recent years

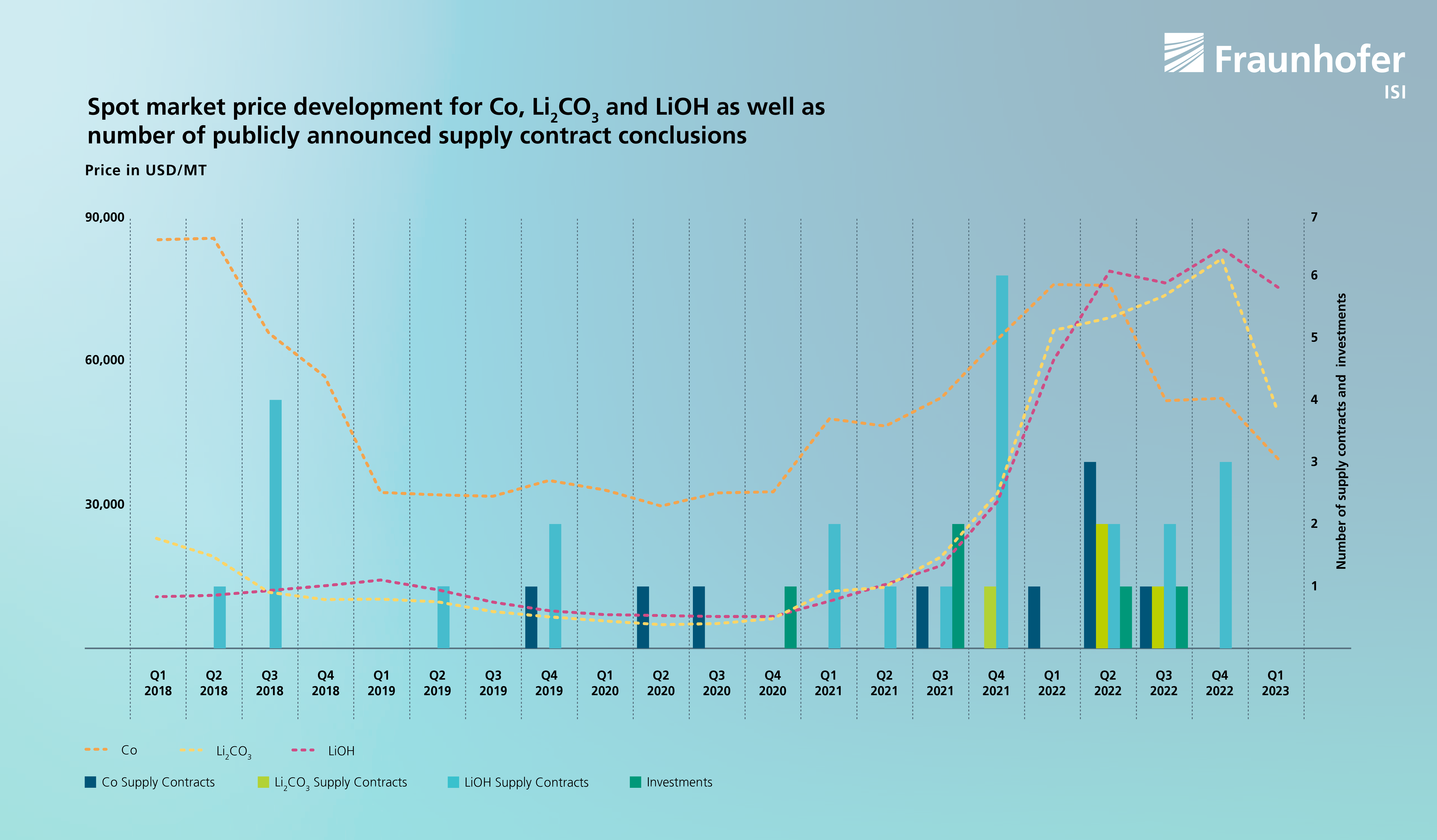

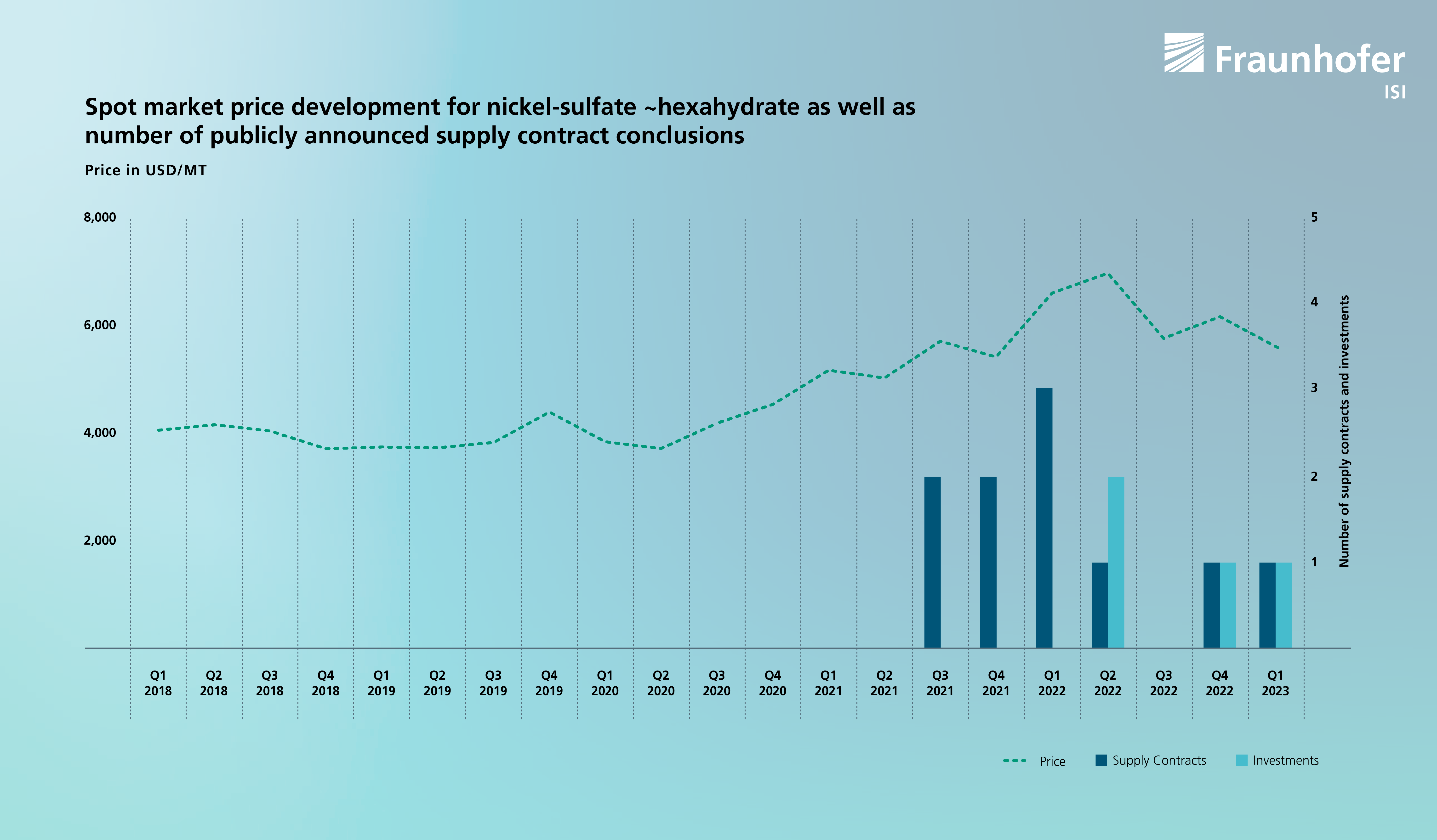

Battery raw materials like lithium carbonate (Li2CO3), lithium hydroxide (LiOH), nickel (Ni) and cobalt (Co) have experienced significant price fluctuations over the past five years. Figures 1 and 2 show the development of material spot prices between 2018 and 2023. Spot market prices reflect instant transactions and may not fully reflect the prices of battery raw materials that material or cell manufacturers had to pay.

The data show a price spread of more than 800% for the Li-compounds and almost 300% for cobalt during the time analyzed. During the post-pandemic recovery, nickel sulfate showed a narrower price spread compared to other raw materials. The materials under investigation are predominantly used in the battery value chain, so that the dynamics are essentially shaped by battery demand and the expansion of production capacities for materials.

Their price therefore particularly reflects market factors such as supply and demand fluctuations. Geopolitical issues and exchange rates further complicate the pricing process. In addition to the fundamental supply-demand dependency, several other factors have influenced the pricing over the last years. The global economic slowdown due to the Covid19 pandemic, for example, may have led to the expectation of decreasing demand for battery raw materials. As a result, prices fell in 2019 and the beginning of 2020. On the other hand, the effort for ecological and ethical sourcing procedures resulted in less reliance on expensive or controversial elements such as cobalt and may have decreased the pressure on supply. The general turmoil in the economy, triggered by the war in Ukraine, is likely to have been a contributory cause to of the sharp rise in material prices in 2022. Not only were international supply conditions called into question by this crisis, but Russia is also a major producer of nickel, which had a direct impact on the supply of battery materials.

Battery manufacturers and OEM are closing long-term supply contracts

Spot market developments and geopolitical developments are also reflected in the timing and manner in which companies secure their access to raw materials. Figures 1 and 2 provide an overview of some supply agreements between raw material producers and their customers made public in 2018 to 2023.

Most supply contracts signed in the last five years were in 2021 and 2022, when market prices were either rising or peaking, with the majority being forward contracts with supply beginning in 2026. The timing and accumulation will on the one hand itself have had a further reinforcing effect on prices, but on the other hand reflects the industry's expectation of a supply situation that will become more difficult in the long term as demand increases.

This uncertainty has resulted in more and more companies, even OEM, to enter into long-term supply contracts for battery raw materials. For example in October 2022, Mercedes-Benz made an announcement regarding a supply agreement with Rock Tech Lithium. Under the agreement, Rock Tech Lithium will supply Mercedes-Benz with an average of 10,000 tonnes of lithium hydroxide per year. Ford has recently announced agreements with five companies to ensure a steady supply of raw materials. In a partnership with Albemarle, Ford secures the delivery of 100,000 tons of lithium hydroxide between 2026 and 2030. Additionally, Ford has secured a portion of annual lithium production from Compass Minerals and EnergySource Minerals, both through their new mine projects in the USA. Ford will also receive up to 13,000 tons of lithium hydroxide per year from Nemaska Lithium in Quebec over eleven years. Furthermore, Ford has entered into a fifth agreement with Sociedad Química y Minera de Chile (SQM) for the supply of battery-grade lithium carbonate and lithium hydroxide.

Among all the contracts screened, the duration of supply contracts is on average five years. While fixed price agreements were also concluded in the past, the supply contracts of the more recent past predominantly have dynamic prices, meaning the price is based on a reference market price at the time of delivery and not on the price at the time of conclusion of the contract. These reference prices are partly based on spot-market prices, but have a lower dynamic. For example, it cannot be assumed that the price increase in 2022 was passed on in full to the large customers who have long-term contracts. Supply on the spot market can now be regarded as the exception rather than the rule. Since most of the supply term will end in the second half of this decade, more contracts could be signed in the coming years.

Automotive industry directly invests in mining projects

In addition, OEMs are changing their raw material purchasing strategy by eliminating intermediaries and buying directly from suppliers. The change in the behavior of market players is apparent: Currently, the supply of raw materials through long-term contracts rather than short-term spot market supply seems to have become the standard. Now, market participants seem to be moving from long-term supply contracts to directly investing in mining projects to offset the risk posed by price fluctuations.

For example, Ford recently made a significant investment of around 4.1 billion EUR in a nickel mining and processing plant project in Indonesia, giving it direct control over the procurement of the nickel it needs. The facility is scheduled to begin operations in 2026. General Motors (GM) has joined the ranks of strategic investors by making a comparable investment in Queensland Pacific Metals, an Australian raw materials supplier. With an investment of approximately 69 million USD, GM aims to develop the Townsville Energy Chemical Hub (TECH) project for nickel and cobalt in northern Australia. Although production costs for raw materials have also increased, e.g. due to rising energy costs, they are still likely to be well below market prices for the vast majority of mining projects. This type of vertical integration, driven by OEMs, can therefore lead to lower manufacturing costs for batteries in the long term.

The impact of raw material cost on battery cell cost

The raw materials discussed are the starting basis for cathode and anode active materials, and in the case of Li compounds also for the electrolyte salt. Other cell components such as the current collector foils, housings or separators can also be subject to price fluctuations, but rarely as significantly as is the case for the metals under consideration. Of course, there is still a long way to go from the raw materials, or the sulfate, carbonate or hydroxide compounds, to the battery material and finally the finished battery cell. The further processing of raw materials into active materials usually involves several steps. In the case of graphite, these are primarily purification and grinding/milling steps, which are intended to reduce unwanted impurities and produce the particle morphologies and size distribution required for the electrochemical properties such as energy and power density. For cathode materials, so-called pre-cathode materials (pCAM) are usually produced in a precipitation reaction in a first step. These already possess the later size, morphology and composition of the transition metals and dopants of the cathode material particles. In a second step, Li compounds are added and the final active material is synthesized at high temperatures. If necessary, this is followed by further steps such as washing processes and particle coating.

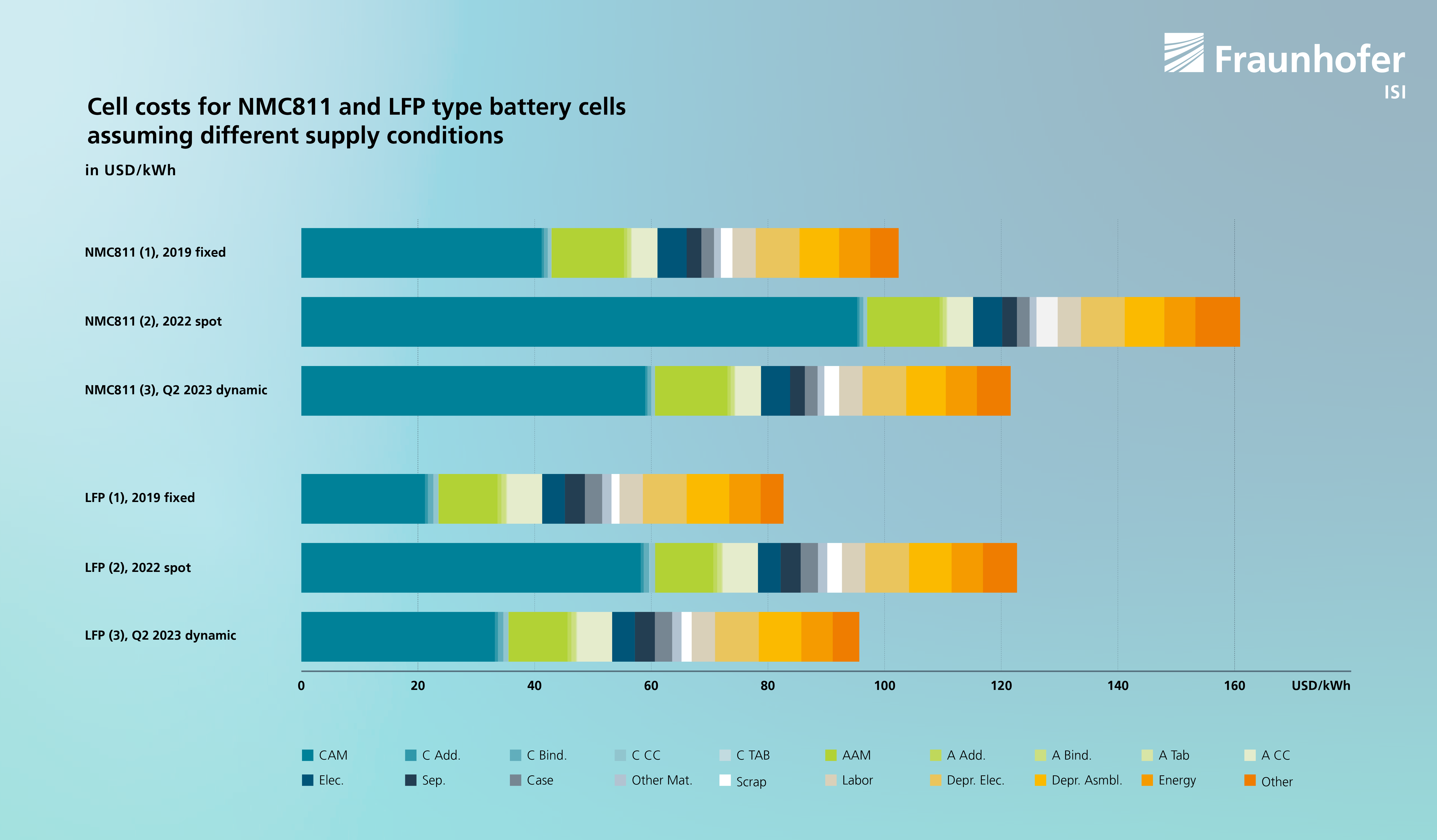

In cell production, the active materials are coated onto electrode foils and assembled with the other components in battery cells. The active materials dominate the LIB cell both in terms of their weight share and their cost share. Accordingly, the cell costs are strongly dependent on the discussed raw material price fluctuations. To evaluate the influence of raw material costs, the CellDesign tool of Fraunhofer ISI was used and evaluated for different supply conditions of the starting materials.

Figure 3 shows the total price of a prismatic NMC811- and a prismatic LFP-cell with a capacity of about 75 and 65 Ah, respectively. Current averaged energy costs for a »European location« and three different material price groups were chosen for the calculations: (1) the mean price level for the carbonate, hydroxide and sulphate precursors from 2019, as it would correspond to a fixed-price contract with a duration until today. This would be very advantageous from the material and cell manufacturing point of view; (2) the mean level of spot market prices in 2022, when important battery raw materials had reached a price high; (3) a price level that would correspond to a dynamic supply contract for the second quarter of 2023, linked to spot market prices.

The difference in cell costs due to purchasing conditions is very significant. While the costs for the NMC811 and the LFP cell were still just over 100 and just over 80 USD/kWh, respectively, under the conditions fixed in 2019, the manufacturing costs of a producer who was forced to purchase at spot market price levels in 2022 would have increased by about 60%. This applies to both cell designs considered, even if the absolute increase for the cheaper LFP cell is admittedly not quite as high. At present, the purchase prices for battery raw materials have probably already benefited from the lower spot market prices, even in longer-running but dynamic contracts. Our estimates give a price level of about 120 USD/kWh for the NMC811 and about 95 USD/kWh for the LFP cell. Regardless of a possible manufacturer's margin, the average prices for EV cells should therefore still be well above the 100 USD/kWh mark.

Fluctuations in raw material prices and resulting fluctuations or increases in cell costs can become a real threat to EV's broad adoption. Also in the future, it can be assumed that there will be deviations between supply and demand of battery raw materials and geopolitical events can also have an impact on the supply chain. The shift in the industry towards low cost materials, most recently with the announcement of a large number of activities on sodium-ion batteries, is likely to continue, but does not promise any immediate relief in the raw material situation. Ultimately, of course, the establishment of new technology chains is demanding and requires a long time. As far as the discussed materials for LIB are concerned, it remains to be seen whether the direct investments of OEMs in mining projects can even lead to a decoupling of battery costs and material prices in the medium term and thus strengthen the spread of EVs.

The data used in this article comes from the BEMA2020 research project, which is funded by the German Federal Ministry of Education and Research (grant number 03XP0272B).

![BMBF_CMYK_Gef_M [Konvertiert]](/en/blog/themen/batterie-update/batterie-rohstoffe-preis-schwankungen-wie-reagiert-automobil-industrie-auswirkungen-zellkosten/jcr:content/fixedContent/pressArticleParsys/textwithasset_208279_1680084229/imageComponent/image.img.jpg/1669109419622/BMBF-gefoerdert-2017-en.jpg)

Last modified: